Payer Insights Survey: Gathering Early Perceptions of Health Plan Response to the Inflation Reduction Act of 2022

Early Insights on Payer Responses to the Inflation Reduction Act

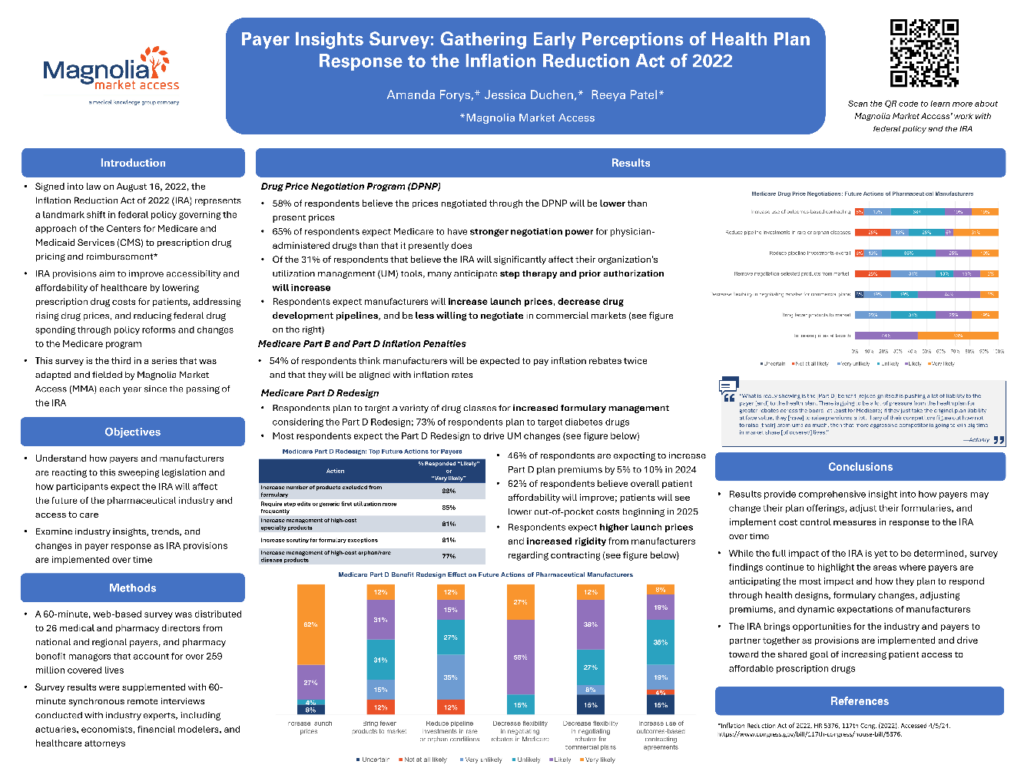

This report provides key findings from Magnolia Market Access’ survey of payers and pharmacy benefit managers (PBMs) covering over 290 million lives. It examines how the Inflation Reduction Act (IRA) is reshaping drug pricing, reimbursement, and access strategies.

Highlights:

- Medicare Drug Price Negotiation Program (DPNP): Payers expect lower Medicare Part B prices compared to current rates but minimal changes for Part D. Manufacturers of non-negotiated drugs may offer larger rebates to remain competitive.

- Part D Redesign: Out-of-pocket costs will be capped at $2,000 annually. Payers plan to implement stricter cost controls, including utilization management, tighter formularies, and increased manufacturer rebate demands.

- Inflation Penalties: 83% of respondents believe these penalties will drive higher launch prices and reduce manufacturers’ flexibility to negotiate commercial rebates.

- Impact on Biosimilars and Generics: Incentives for biosimilar competition are expected to grow, while incentives for generics remain stable.

Download to get detailed insights into how the Inflation Reduction Act is reshaping drug pricing, reimbursement, and access.